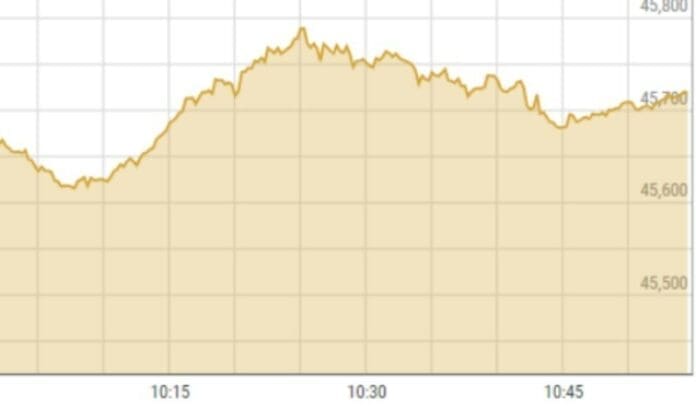

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 index witnessed a significant gain of more than 400 points on Monday, driven by assurances from the army chief regarding transparency in the foreign exchange rate. The index reached 45,730.16 points at 11am, marking a 0.92% increase or 417.51 points from the previous closing at 45,312.65 points.

The positive sentiments were attributed to the army chief’s pledge to enhance transparency in dollar rates and bring exchange companies under the purview of taxation. Arif Habib Corporation Ltd analyst Ahsan Mehanti stated that the army chief’s assurance played a crucial role in the bullish activity observed in the stock market.

During a meeting with the business community at the Lahore Corps headquarters, Chief of Army Staff (COAS) General Asim Munir revealed that task forces focused on economic matters and different sectors had been established to strengthen economic decision-making. The potential visit of Saudi Crown Prince Mohammed bin Salman, aimed at potential investments in the Special Investment Facilitation Council, also contributed to the positive market sentiment.

Raza Jafri, Head of Equity at Intermarket Securities, explained that the KSE-100 index was gradually recovering from previous losses as authorities took measures to restore confidence in the economy, specifically in terms of foreign direct investment and the stability of the rupee. However, he cautioned that volumes were low, and a cautious approach was still prevalent until further clarity emerged.

Ali Malik, CEO of First National Equity, echoed the positive impact of the army chief’s meetings with businessmen in Karachi and Lahore. Gen Munir emphasized the need for increased investments in the agricultural and mining sectors while expressing “zero tolerance” towards smuggling activities. Malik further stated that these developments had instilled positivity and confidence among investors, referring to the surge as a course correction and expressing hope for a stable market moving forward.